Don't let severe weather slow down operations! Schedule delivery up to a month in advance to avoid delays!

Shipping Container Market Disrupted By Tariff Uncertainty

How tariffs are poised to disrupt container availability & global shipping costs.

How Tariffs Will Impact the Used Shipping Container Market

(Updated – June 3, 2025) As earlier reported, the uncertainty and anticipation surrounding the tariffs created a significant increase in import activity from late 2024, until tariffs were officially announced in April. This surge was followed by a sudden decline in import activity to all major ports nationwide. As a result, a notable decrease in the number of incoming ships at major ports impacted the availability of used containers. This notice is also supported by data provided by:

- Port of Los Angeles: According to the CEO of the Port Of LA, the port has seen 30% fewer ships arriving recently.

- Port of Seattle: The CEO of the Port of Seattle mentioned the port is currently completely empty, a rare and striking development.

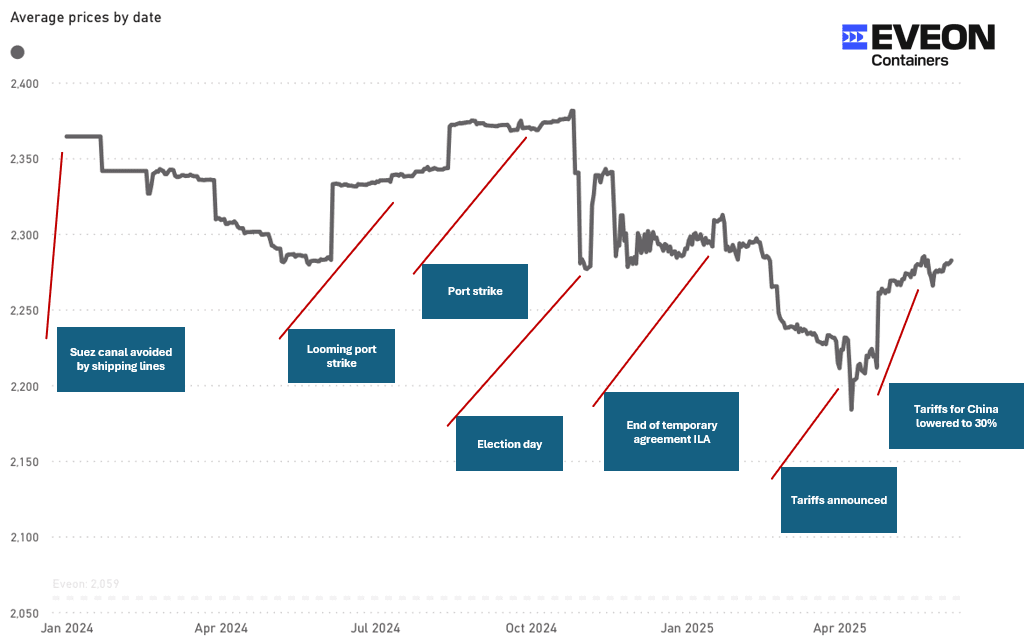

The uncertainty in the market caused container prices in the market to go up as of week 15 (April 7-13):

Source: Eveon Container's price monitor for 45 locations in the US reflecting the average price of all three major shipping container types from more than 10 different suppliers in the US market shown in weeks before June 3, 2025.

China which accounts for 40% of inbound containers in US saw tariffs fluctuate from 145% to 30% in a 90-day period. As a result, the transport of goods (vessels sailing to US) increased to extremely high levels until April, then dropped significantly in April and May by roughly 10-15%. The impact of the falling imports on shipping container availability trickles down with a serious delay in time because of the nature of how supply chains work.

Used Shipping Container Prices Expected to Normalize If Tariff Agreements Are Finalized in the Next 90 Days

Looking ahead, it is realistic to expect that shortages in specific areas may occur as a delayed effect of the falling imports and consequently prices could go up during at least the next 4 to 5 weeks. As tariffs for Chinese products have been lowered for a period of 90 days, a new surge of imports to take advantage of this 90-day time window is expected to hit the ports as of early July. Over the course of July we could expect availability of used shipping containers to improve again and prices to stabilize or show a downward trend.

However, if the window for imports continues to exist, imports might hit exceptionally high levels that could lead to shipping lines evacuating empty shipping containers back to China. This effect was also seen during the pandemic and led to shortages and record high pricing for shipping containers in the US. If this happens again, the US market could be faced with a longer lasting, substantial shortage of shipping containers and a continued upward trend of pricing.

Please note while developments in tariffs are encouraging for long-term supply chain normalization, no agreement on tariffs has been finalized yet. Moreover, tensions between China and the US have increased over the past few days as both parties accuse the other of violating the deal that enabled the 90-day period with lower tariffs.

Trade Agreements & Global Tariffs Still the Great Unknown

At this moment the only certainty is uncertainty, Eveon recommends businesses that rely on containers for their core processes or for crucial projects, secure supply as soon as possible to avoid any disruptions of their business.

Our team will continue to monitor the situation closely and provide notable industry updates as they become available. If you have any questions, require further clarification on recent news or would like to secure your supply for shipping containers, please call an agent at 888-489-7585 or shop online.

(Updated – May 5, 2025) In the current global trade environment, few factors are proving as disruptive—and consequential—as tariffs and their domino effects on imports, exports, and the container logistics industry. Recent data shows that the economic tug-of-war between the U.S. and China is having significant and multifaceted repercussions across the global supply chain. As international tensions rise, trade slows, and logistics systems strain under new pressures, both businesses and consumers are beginning to feel the pinch.

The U.S.-China trade landscape has shifted dramatically due to President Trump's imposition of tariffs up to 145% on most Chinese imports, including toys, electronics, and household goods. This escalation has intensified supply chain disruptions, particularly as businesses prepare for the back-to-school and holiday shopping seasons. Retailers and suppliers are on high alert, anticipating significant slowdowns and congestion in the industry

In response to these tariffs, Chinese exporters are employing "place-of-origin washing," rerouting goods through third countries like Malaysia to obtain new certificates of origin and bypass U.S. tariffs. This practice has raised concerns among U.S. business partners and Asian nations about becoming unintended intermediaries. The economic impact is already evident. The U.S. economy contracted in the first quarter of 2025 for the first time in three years, partly due to pre-tariff stockpiling of imports.

Additionally, the logistics industry faces increased shipping costs and longer transit times. Ocean freight routes from China to the U.S. East and Gulf Coasts are restricted by the Panama Canal's limitations, and the Suez Canal isn't a viable alternative due to conflict in the Red Sea. These challenges are expected to exacerbate supply chain disruptions as we approach the second quarter's busy season. Source: Global Trade Magazine

As the leading provider of decommissioned (used) containers in North America, Eveon is committed to transparency in availability, pricing and industry trends. We only sell what we have in stock and proactively inform our customers about market factors that may impact inventory levels and pricing. When inventory of goods is disrupted at any part of the supply chain, so are the prices and demands of the Corten Steel box in the heart of it all.

Sharp Decline in Global Trade Volumes

The figures speak volumes. Global twenty-foot equivalent unit (TEU) bookings—used to measure containerized cargo capacity—have plummeted by a staggering 49%. The U.S., one of the world's largest trading hubs, has seen its import volume fall by 64%. Imports from China, specifically, have matched this decline, also dropping 64%, while U.S. exports to China have decreased by 36%. These are not small shifts—they represent a massive contraction in trans-Pacific trade that has downstream implications for nearly every player in the logistics and manufacturing sectors.

This decline is not solely the result of tariffs but is certainly exacerbated by them. A newly announced fee on Chinese ships docking in U.S. ports (as reported by CNN) could suppress trade flows even further, particularly if China responds with retaliatory measures. The message is clear: shipping is becoming more expensive, and less predictable. Still unclear about tariffs and their effect? Learn more about everything you need to know but were afraid to ask.

The Emergence of ‘Blank Sailings’ and What They Mean

Adding to the complexity are widespread "blank sailings"—scheduled container ship voyages that are canceled due to insufficient cargo to justify the trip. Shipping lines are unwilling to cross the Pacific with partially filled vessels, and as a result, fewer ships are departing. While this may seem like a reasonable cost-saving measure for carriers, it leads to additional supply chain disruptions. Containers that are already in short supply in certain regions may not return quickly, worsening regional shortages and creating bottlenecks in availability.

This growing imbalance is starting to show up in the market. With fewer containers being moved, and blank sailings becoming common, it’s likely that container shortages will intensify over the coming weeks and months.

Implications for Container Stock and Pricing

Container fleet owners and leasing companies are preparing for what could be a prolonged period of constrained supply. The likely scenario is twofold:

- Rising Prices: As availability dwindles, prices are poised to rise. Container users—especially those needing large volumes for industrial or manufacturing operations—should consider locking in supply now, while pricing is still relatively favorable.

- Limited Availability: Certain geographies may face serious shortages. If blank sailings and decreased trade volumes persist, containers could become unavailable in key logistics hubs for extended periods.

Recommendations for Customers

- Act Early: If your business depends on container availability, now is the time to secure stock. Delays could mean paying more—or worse, being unable to source containers at all.

- Monitor Competitor Movements: With others already raising prices, market indicators show that prices are trending to increase as inventory reduces.

- Plan for Longer-Term Disruption: This isn’t a short-lived blip. Ongoing trade tensions, tariffs, and logistical hurdles suggest a prolonged period of market volatility.

As global trade adapts to political and economic headwinds, businesses must remain informed and proactive. Container pricing and availability are early indicators of broader shifts.

For those monitoring the prices or concerned about inventory please stay tuned to developments. For a real-time quote on a 20ft or 40ft shipping container from Eveon click here.